General Electric Company through its subsidiary GE Germany Holdings AG, Frankfurt am Main, submitted a voluntary public takeover offer to the shareholders of publicly listed SLM Solutions Group AG, Lübeck. Network Corporate Finance advised SLM Solutions Group in connection with the transaction and provided the management board and supervisory board with a fairness opinion.

Transaction

On September 6, 2016 General Electric published its decision to submit a voluntary public takeover offer to the shareholders of SLM Solutions Group in accordance with the German Securities Acquisition and Takeover Act. On September 26, 2016, General Electric offered the shareholders a price of EUR 38.00 per share, equalling an equity value of EUR 683.3 million. Network Corporate Fi-nance advised SLM Solutions Group in connection with the transaction and provided the management board and supervisory board with a fairness opinion. The minimum acceptance threshold of 75% failed to be met.

Company

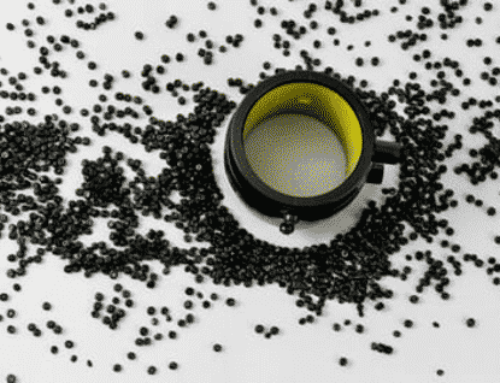

SLM Solutions Group is a leading provider of metal-based 3D-additive manufacturing technology. The shares are traded in the Prime Standard of the Frankfurt Stock Exchange and are TecDAX listed. SLM Solutions Group focuses on the development, assembly and sale of machines and integrated system solutions in the field of selective laser melting. In 2016 SLM Solutions Group employed over 310 staff globally. The products are utilised worldwide by customers in particular from the aerospace, energy, healthcare and automotive industries.

For additional information on SLM Solutions: www.slm-solutions.de