Network Corporate Finance has advised the Schüler founder family on the sale of 100% of their shareholding in GALFA Industriegalvanik GmbH in Finsterwalde.

Transaction

Under the company succession, the Wolfgang Schüler family has sold 100% of its shareholding in GALFA Industriegalvanik GmbH in Finsterwalde. The sale was made to an acquiring company in which private investors have a 76% shareholding and the management of GALFA Industriegalvanik GmbH has a 24% interest. The acquiring company was advised by the Argos portfolio management company in Munich.

Target Company

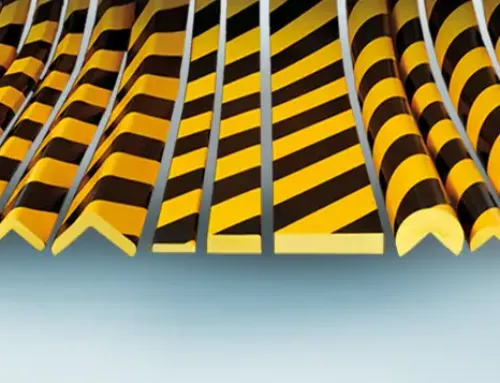

In 1992, GALFA Industriegalvanik was hived off from the electroplating division of the former "PGH Frieden" production cooperative. The company concentrates on the coating of small-scale and mass-produced metallic parts, principally for customers in the automotive industry, and has shown continuous growth in the last 15 years. GALFA is one of the most successful commission finishers in Germany.

Key Facts

| Transaction value: | not disclosed |

| Sector: | Metal industry |

| Sales: | EUR 15,0 million (2007e) |

| Employees: | 110 |

| Date | December 2007 |

Clients

The Wolfgang Schüler founder family, Finsterwalde

The role of Network Corporate Finance

Network Corporate Finance advised the clients and the company on the structure and execution of the sales process. Following the preparation of the transaction documents, Network Corporate Finance approached selected strategic investors and financial sponsors within the framework of a supervised auction, coordi-nated the due diligence conducted by a limited number of interested parties, negotiated the economic aspects of the sale and purchase agreement and secured compliance with the closing conditions.